Probate refers to the judicial process whereby a will is “proved” in a court of law and accepted as a valid public document that is the true last testament of the deceased, or whereby the estate is settled according to the laws of intestacy in the absence of a legal will. This process ensures that the deceased’s assets are correctly distributed to their heirs and designated beneficiaries. The procedure can vary significantly between states but generally involves validating the deceased’s will, appointing an executor, and overseeing the distribution of the estate.

Purpose and Importance of Probate

Probate serves several crucial purposes within the realm of estate management and real estate. Firstly, it confirms the validity of a will, ensuring that the deceased’s wishes are honored legally and ethically. Secondly, probate protects the rights of creditors and beneficiaries. It guarantees that all debts and taxes owed by the deceased are paid before any assets are distributed to the heirs. This legal oversight helps prevent fraudulent claims and ensures that the distribution is equitable according to the terms set forth in the will or state law.

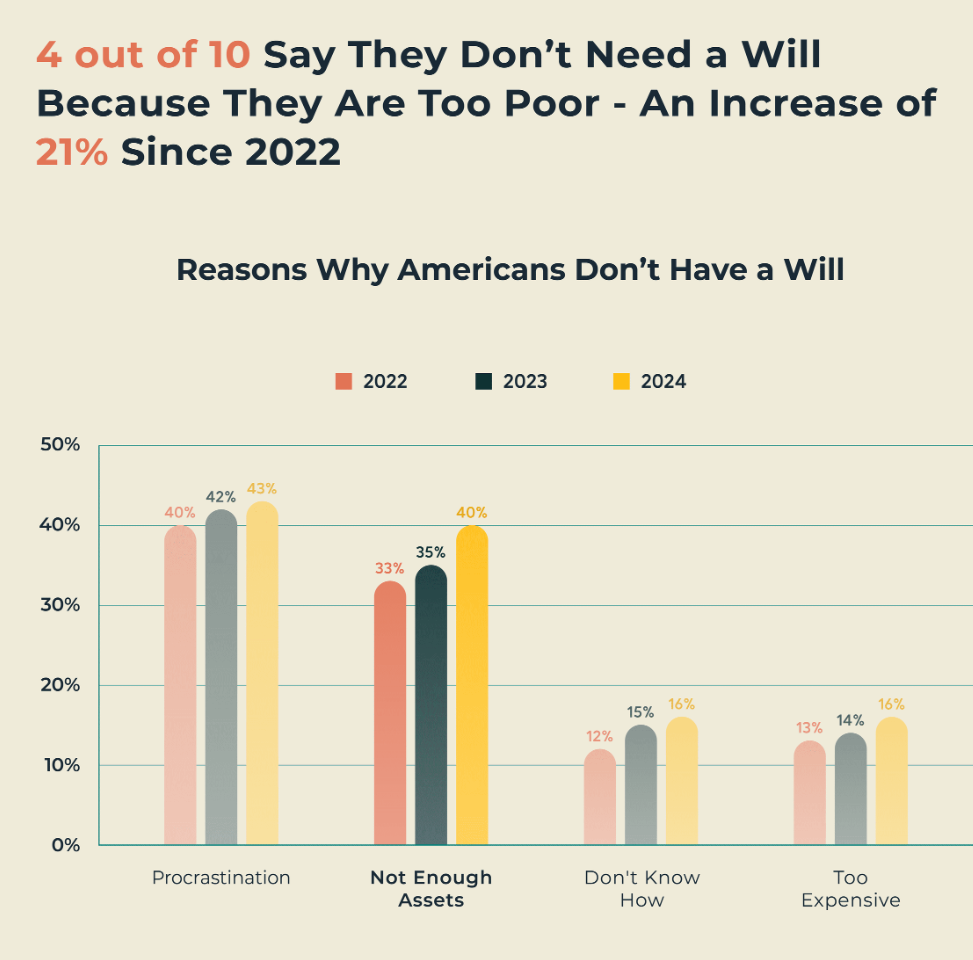

Source: Caring.com

Role of the Executor

The Executor is a person designated in the will or appointed by the court to oversee the process of probate. This role is pivotal in managing the deceased’s estate from start to finish. Responsibilities of the executor include filing the will with the probate court, notifying banks, creditors, and public agencies of the death, managing the estate’s assets, paying off debts, and eventually distributing the remaining assets to the rightful beneficiaries. It’s a role that requires meticulous attention to legal and financial details, often necessitating the assistance of legal professionals.

Steps in the Probate Process

The Probate Process can vary by state, but generally follows a set of core steps that ensure the deceased’s estate is settled appropriately:

- Filing a Petition: To begin probate, a petition must be filed with the probate court to either admit the will to probate and appoint the executor or, if there is no will, to appoint an estate administrator.

- Notifying Heirs and Creditors: Once the court appoints the executor, they must notify all potential heirs, creditors, and the public of the death, typically through newspaper advertisements.

- Inventorying Assets: The executor is responsible for taking an inventory of all the deceased’s assets, which includes everything from real estate to stocks, and personal belongings.

- Paying Debts and Taxes: Before any distribution, all of the estate’s debts and taxes must be paid. This may involve selling estate assets to cover outstanding obligations.

- Distributing the Remaining Assets: After all debts and taxes are settled, the executor distributes the remaining estate to the beneficiaries as specified in the will or according to state law if there is no will.

- Closing the Estate: Finally, the executor will file a petition with the court to close the estate, showing that all debts and distributions have been completed as directed and requesting release from the role of executor.

Identifying and Valuing Assets

A critical step in the probate process is the Identification and Valuation of Assets. This task involves cataloging every asset owned by the deceased at the time of their death and subsequently appraising their value. This not only includes real estate properties but also other items like stocks, bonds, business interests, and personal belongings such as jewelry and art.

- Creating an Inventory: The executor compiles a detailed list of all assets, which can be facilitated by reviewing tax returns, bank statements, and other financial documents.

- Professional Appraisals: For items like real estate and high-value collectibles, professional appraisals are often necessary to determine the fair market value.

- Financial Accounts: Assets such as bank accounts and stock portfolios are valued based on the statements at the date of death.

This thorough approach ensures that the estate is accurately valued, which is essential for equitable distribution and for calculating any owed estate taxes.

Paying Debts and Taxes

Paying Debts and Taxes is a mandatory step in the probate process that must be handled before distributing assets to the beneficiaries. This step ensures that the estate settles all financial obligations, thus protecting the executor and the beneficiaries from future liabilities.

- Identifying Obligations: The executor needs to determine all outstanding debts, including credit cards, loans, and utility bills, as well as any legal claims against the estate.

- Filing Tax Returns: It is crucial to file any outstanding personal tax returns of the deceased and estate tax returns. Depending on the estate’s value and the laws of the state, federal estate taxes might also need to be paid.

- Paying Debts: Using the estate’s assets, the executor pays off the debts in a prioritized order dictated by law. If necessary, assets may be sold to cover these debts.

- Release Notices: Once all debts and taxes are paid, the executor can issue notices to creditors and the court, demonstrating that all obligations have been fulfilled.

This meticulous financial management protects the estate’s integrity and ensures that the distribution of assets to beneficiaries is done without any legal complications.

Distributing the Estate to Beneficiaries

Distributing the Estate to Beneficiaries is the final step in the probate process, where the executor allocates the deceased’s assets according to the will or state law, if there is no will. This phase is critical as it actualizes the deceased’s wishes or the legal requirements of inheritance.

- Allocation According to the Will: If a will exists, the executor follows the specific instructions laid out for distributing assets to the named beneficiaries.

- Intestate Succession: In the absence of a will, assets are distributed according to intestate succession laws, which typically prioritize close relatives such as spouses and children.

- Transfer of Ownership: Legal documents are prepared and filed to transfer ownership of properties, vehicles, and other assets. This might involve deeds for real estate, titles for vehicles, and transfer forms for accounts.

- Final Accounting: The executor prepares a final accounting that outlines all income, expenses, and distributions of the estate, which must be approved by the probate court before the estate can be closed.

Probate vs Non-Probate Assets

Understanding the distinction between Probate and Non-Probate Assets is essential for anyone involved in estate planning or handling an estate after someone’s death. This knowledge helps in preparing for how different assets are handled legally upon one’s passing.

- Probate Assets: These are assets that require the probate court’s involvement to be transferred to the beneficiaries. Typically, these include assets solely in the deceased’s name without a designated beneficiary, such as individual bank accounts, real estate owned solely by the deceased, and personal possessions.

- Non-Probate Assets: These assets bypass the probate process and transfer directly to the designated beneficiaries upon the owner’s death. Examples include life insurance policies with a named beneficiary, retirement accounts like IRAs and 401(k)s, and properties held in joint tenancy or with rights of survivorship.

- Benefits of Non-Probate Assets: Avoiding probate speeds up the transfer of assets to beneficiaries, reduces legal and court fees, and maintains privacy since probate records are public.

This differentiation helps streamline estate planning and can significantly impact how quickly and smoothly assets are passed on after death.

Identifying and Valuing Assets

A critical step in the probate process is the identification and valuation of assets, which involves cataloging every asset owned by the deceased at the time of their death and subsequently appraising their value. This task extends beyond real estate to include items like stocks, bonds, business interests, and personal belongings such as jewelry and art.

The executor is responsible for creating an inventory by compiling a detailed list of all assets, often facilitated by reviewing tax returns, bank statements, and other financial documents. For items like real estate and high-value collectibles, professional appraisals are typically necessary to determine their fair market value.

Assets such as bank accounts and stock portfolios are valued based on the statements at the date of death. This thorough approach ensures that the estate is accurately valued, which is essential for equitable distribution and for calculating any owed estate taxes.

Paying Debts and Taxes

Paying debts and taxes is a mandatory step in the probate process that must be handled before any assets are distributed to beneficiaries. This stage ensures that the estate settles all financial obligations, thus protecting the executor and beneficiaries from future liabilities.

The executor needs to identify all outstanding debts, including credit card balances, loans, utility bills, and any legal claims against the estate. Additionally, it is crucial to file any outstanding personal tax returns of the deceased, as well as estate tax returns. Depending on the estate’s value and the laws of the state, federal estate taxes might also need to be paid.

The executor uses the estate’s assets to pay off the debts in a prioritized order dictated by law. If necessary, assets may be sold to cover these debts. Once all debts and taxes are paid, the executor can issue notices to creditors and the court, demonstrating that all obligations have been fulfilled. This meticulous financial management protects the estate’s integrity and ensures that the distribution of assets to beneficiaries is done without any legal complications.

Distributing the Estate to Beneficiaries

Distributing the estate to beneficiaries marks the final step in the probate process, where assets are allocated according to the deceased’s will or, in the absence of a will, according to state law. This phase is crucial as it actualizes the deceased’s wishes or the legal requirements of inheritance.

If a will is present, the executor follows the specified instructions to distribute assets to the named beneficiaries. In cases where no will exists, assets are distributed based on intestate succession laws, which typically prioritize immediate family members like spouses and children.

During this process, legal documents are prepared and filed to transfer ownership of properties, vehicles, and other significant assets, involving deeds for real estate and titles for vehicles. The executor also prepares a final accounting that outlines all transactions made throughout the probate process, including all income, expenses, and distributions.

This report must be approved by the probate court before the estate can be officially closed, ensuring that all actions taken align with legal standards and are transparently recorded.

Probate vs Non-Probate Assets

Understanding the distinction between probate and non-probate assets is essential for anyone involved in estate planning or handling an estate after someone’s death. This knowledge helps in preparing for how different assets are handled legally upon one’s passing.

- Probate Assets: These are assets that require the probate court’s involvement to be transferred to the beneficiaries. Common examples include assets solely in the deceased’s name, such as individual bank accounts and real estate owned solely by the deceased, as well as personal possessions.

- Non-Probate Assets: These assets bypass the probate process and transfer directly to the designated beneficiaries upon the owner’s death. This category includes life insurance policies with a named beneficiary, retirement accounts like IRAs and 401(k)s, and properties held in joint tenancy or with rights of survivorship.

- Benefits of Non-Probate Assets: Avoiding probate speeds up the transfer of assets to beneficiaries, reduces legal and court fees, and maintains privacy, as probate records are public.

The clear differentiation between these two types of assets helps streamline estate planning and can significantly impact the efficiency and privacy with which assets are passed on after death.

Source: LeagalZoom

Challenges and Disputes in Probate

Navigating probate can often lead to challenges and disputes, making an already complex process even more daunting. Disputes typically arise over the interpretation of the will’s provisions, the valuation of assets, or the fairness of debt and asset distribution.

These issues can stem from unclear language in the will, alleged undue influence over the deceased prior to their death, or conflicts among beneficiaries with competing interests. Furthermore, executors may face accusations of mismanagement or breach of fiduciary duty, which complicates the process and can lead to legal battles that may extend the duration and cost of probate significantly.

To mitigate such challenges, clear communication, thorough documentation, and the engagement of professional legal and financial advice are crucial. This strategic approach helps ensure that the executor fulfills their responsibilities accurately and fairly, potentially reducing the likelihood of disputes and maintaining harmony among all parties involved.

Frequently Asked Questions About Probate

Why Do You Need Probate?

Probate is necessary to legally transfer the ownership of the deceased’s assets when they pass away. It ensures that debts and taxes are paid, and the remaining assets are distributed according to the deceased’s will or, if no will exists, according to state law. This process provides a clear legal framework to handle the complexities of estate distribution and helps prevent potential disputes among beneficiaries.

What Are the Disadvantages of Probate?

The disadvantages of probate include its potential to be time-consuming and costly. The process can be lengthy, often taking several months to years to complete, especially if the estate is large or involves complex assets. Additionally, probate fees and the costs associated with hiring attorneys can diminish the value of the estate, reducing the amount passed on to beneficiaries.

How Long Is Probate in California?

In California, the duration of probate can vary significantly but typically takes about nine months to two years. The timeframe depends on the size and complexity of the estate, the presence of any disputes, and the efficiency of the probate court handling the case.

How Much Does Probate Cost in California?

The cost of probate in California can vary widely based on the estate’s value and complexity. Generally, attorney fees and court costs are calculated as a percentage of the estate’s value, which can range from a few thousand to tens of thousands of dollars. Specific fees are set by state law and are scaled with the size of the estate, making larger estates more expensive to probate.

Wrap Up

Probate is a vital process for managing and finalizing the affairs of a deceased person’s estate. It ensures that all legal, financial, and personal aspects are handled according to the law and the wishes of the deceased, if known.

Understanding probate is essential for homeowners, real estate investors, and realtors, as it directly impacts how properties and other assets are dealt with after someone’s death. By demystifying the steps and requirements of probate, individuals can better prepare for the eventualities of estate management, potentially easing the burden during a challenging time.

As we’ve explored, while probate can be complex and sometimes lengthy, being well-informed can help streamline the process and prevent common pitfalls.